People Twitter

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a pic of the tweet or similar. No direct links to the tweet.

- No bullying or international politcs

- Be excellent to each other.

- Provide an archived link to the tweet (or similar) being shown if it's a major figure or a politician. Archive.is the best way.

Yeah this one or the bicycle meme

He’s not getting hurt like in the bicycle meme though, just hurting others.

I can walk into a bank today with a mortgage cheaper than rent, and I’ll be denied cause I don’t make enough money, explain that logic to me.

Landlords don't care if your rent is sustainable for you in the long term. They have nothing to lose if at one point you can't afford it anymore, someone else will.

Banks on the other hand care very much if you'll be able to pay your loan in full. Even with the house as collateral, it's much better for them if you just paid your loan instead of them having to deal with all that.

"they get the house if you don't pay" really isn't so great after you've look at what they actually get for those houses.

Generally, people don't get foreclosed on when their house looks super fancy and well maintained.

Also debt is an asset for banks. Having people in debt for 30 years is better than having people in debt for 10 years and then selling their house.

They only get to force the sale of the house to recoup their loan, you get to keep the extra from the sale. House sells for $300k, you owed $250k you walk away with $50k and the bank gets their money back.

But on auction, the bid is usually FAR below the normal asking price.

If something were to happen, and you couldn't make rent, you might get evicted, which would be inconvenient.

If something were to happen, and you couldn't make the mortgage, the bank might lose money, which is unconscionable.

Not sure if you're in America but credit scores are some rigged ass bs. What do you mean paying off a loan made my score lower?? I have more disposable income!

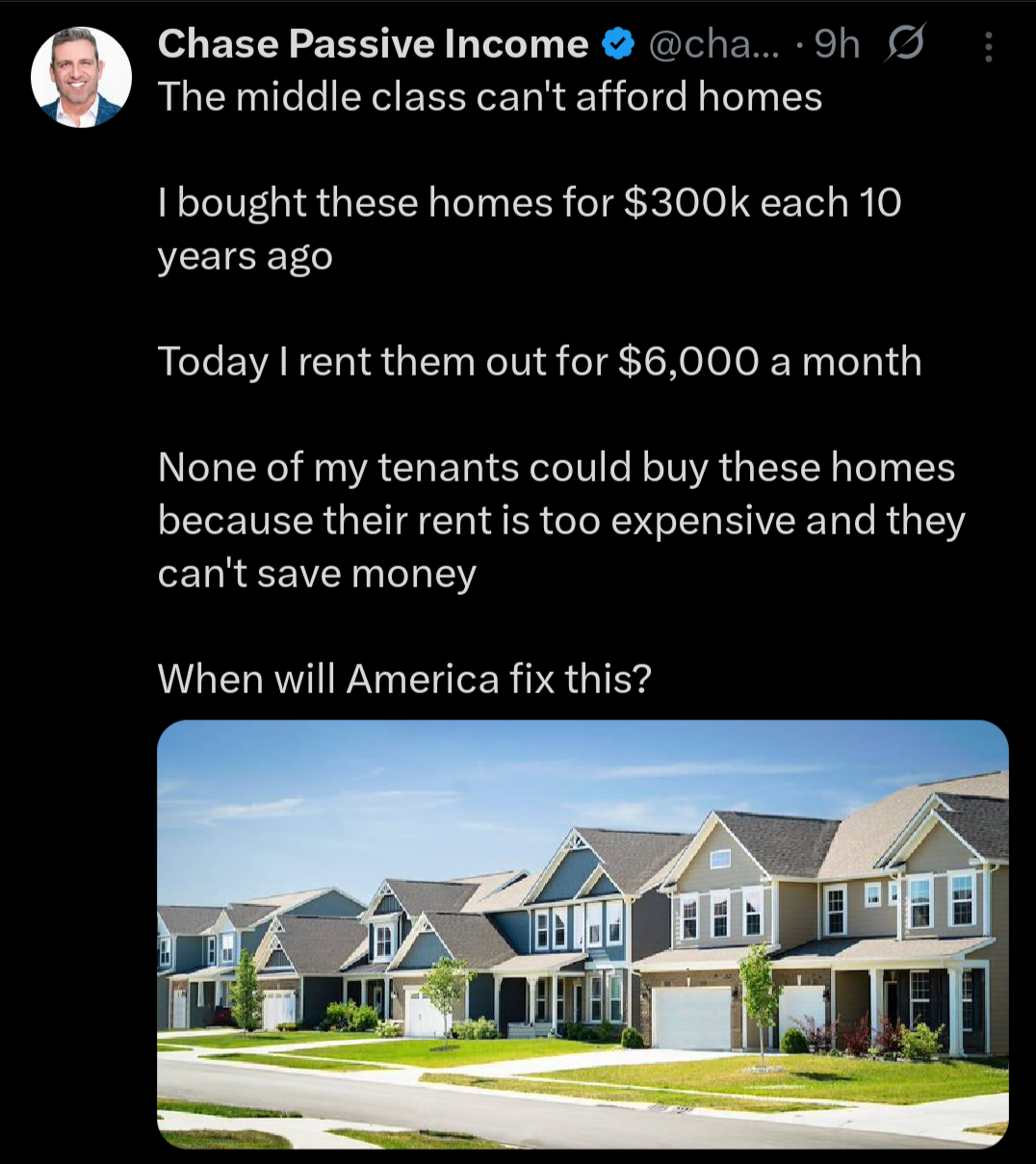

A) This is a hoax account

B) You can still get cheaper housing if you don't live in the whitest, red-lined-ass, suburban enclaves in your state

C) Even then, it doesn't matter, because landlords primarily benefit from very low borrowing costs rather than low housing costs. A $300k house was still functionally unaffordable to anyone earning $45k/year, unless your credit score got you one of those sweet sub-3% ZIRP era loans. Renting was effectively paying a vig to a guy with a better interest rate than you.

D) ZIRP also flooded the market with the excess cash that made $300k basic bitch housing possible. And then turned those $300k homes into $600k homes 15 years later.

E) Build Public Housing

F) And municipal mass transit, so you don't have to sit in traffic for a hour every day

This is a hoax account

I hope so. The dissonance and lack of self-awareness in the post was so profound, my head is still ringing.

I saw quite a few Chase Passive Income posts and all of them feel like satire

This isn't small timers, it's corporations buying up all of the housing, building only "luxury" apartments and price fixing the fuck out of the rent.

Then they spout "Trickle Down Housing" where the "luxury" apartments will be available in 30 years.

The guy said "these houses, ...each" so he could own the whole area and jack up the rents, not be a small timer. But yeah, it's not the person renting out Grandma's old place to help pay for her nursing home.

Lots of people seem to be missing this - Chase Passive Income is a satirical account.

I don't know how they could miss that. It is very clearly a satirical post. No rich people are either that self aware or interested in outing themselves as greedy useless pieces of shit.

Is this satire?

Yes.

The fact that we have to ask this is the point I think.. Hilarious post btw! 🤣

This is the, “If I don’t do it, someone else will,” argument. Which is true.

There is always all least one other ass hole out there.

Yes, this is a satire account, but I've heard the exact same crap from so-called "small landlords" who think clearly the problem is someone else.

Every small contributor that makes up the bulk of the problem thinks the REAL problem is the one that's bigger than them and they're the small potatoes, or the good one.

This applies to EVERYTHING. Not just property.

There should be nothing wrong with owning multiple houses. But your property tax should be adjusted on every house you own depending on the number of houses that own. It should be completely cost prohibitive at a certain point to own more than 2 or 3 homes. It should kick in after a year or two, so that it gives people more than enough time to purchase a new home, fix it up or renovate, and then time to sell the previous house. Owning houses shouldn't be a profit-making venture.

Societal problems should be solved by the government, not by individual actions.

That's very nice. Now please face the wall.

I get that it's satire but it makes a good point. It is the government's problem that renting out property is financially incentivized. We can't expect any significant number of landlords to start charging below market rent. Especially because many of those landlords are public corporations who must act in the interest of their shareholders, directly against the interests of their tenants. This is the government's problem to regulate and in absence of the regulation effort is better spent targeting government than individual landlords/corporations imo. Ya the government won't do anything, they are the landlords after all, but at least there's a path to changing the financial incentive through government.

The problem tellimg the country to… remove him? Thats a first

This has to be satire. TELL ME IT'S SATIRE!

Who rents that for 72'000 $ per year? At that point you are throwing away your money and most definitely have enough to actually buy a home.

have you seen how this works? i know this is a parody post but it’s real. Rent starts “ok” then the “market” (which is just this guy with 6 props) says rent can be higher. So it bumps. Then inflation. Then covid. Then “market” again.

While the owner know how his tenants salary is tracking, keeping sure to raise the rent by enough to keep him there but not so much he bails.

it’s not the renters fault they need a place, even if one says “yeah but they overspent.” Not initially, no. Maybe some. Tough nuts. But often it’s not initially overspending.

Then again capitalism itself relies on and markets for people thinking they “need” more than they do; the owner of the props is counting on it.

Landlords are scum and deserve nothing.

Who rents that for 72’000 $ per year?

Andrew Cuomo bragged about renting for $96k/year

At that point you are throwing away your money and most definitely have enough to actually buy a home.

You don't need a 20% down payment to rent a home. That's the big hurdle, as housing prices have ballooned

Trying to save up 20% was the biggest mistake of my home buying experience.

My whole fucking life my parents insisted that you had to have 20% down, so that's what I aimed for. Both my siblings just YOLOed and bought houses between 5-10% down, but I had a better paying job, so continued to save. As I saved, the cost of housing out grew my rate of savings.

When I finally did get a mortgage I only put 15% down and it was at that point I realized that the only thing the 20% down would do for me was save me something like .75% for the first 5-8 years. That is still a lot of money, but compared to just buying a house at $175,000 10 years ago and selling it for double when I ended up moving anyway--it's nothing.

The whole system is fucked. There's no reason only those making 6 figures or more should be the only ones with the privilege of trying to own the place you live someday. There's no reason a company should own a place to live. There's no reason minimum wage shouldn't cover a reasonable lifestyle for a family. There's no reason housing in general shouldn't be available to everyone.

Pre covid, I was pre approved for a home. I had lied and told them I had $3K for a down payment.

I couldn't save three grand. Rent was 40% my income, as was childcare. I made $20/hr in a "grown up" job, the type of work my uncles and aunts and parents bought houses with.

The gorgeous $167K dollar house (2016) who's only down side was it was 45mins from work, .. is now worth nearly $600K. I'm jealous of whoever ended up buying it that year.